Medicare Advantage Agent for Beginners

Table of ContentsSee This Report on Medicare Advantage AgentThe Definitive Guide for Medicare Advantage AgentThe Greatest Guide To Medicare Advantage AgentMedicare Advantage Agent Can Be Fun For AnyoneThe Main Principles Of Medicare Advantage Agent Medicare Advantage Agent - The Facts

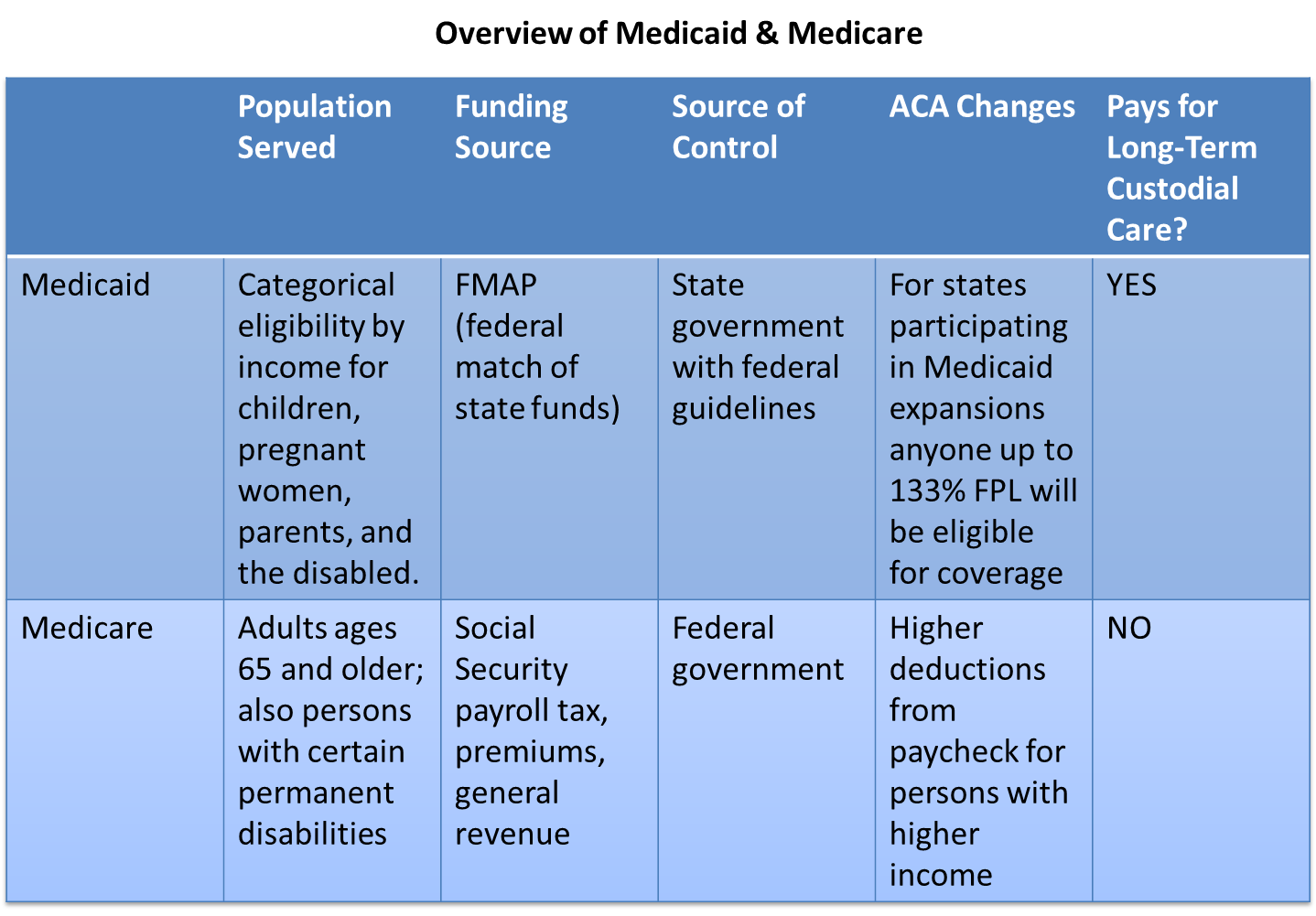

In addition, it concentrates specifically on those without any kind of medical insurance for any length of time. The problems dealt with by the underinsured are in some areas comparable to those encountered by the without insurance, although they are usually much less extreme. Uninsurance and underinsurance, however, involve clearly different plan issues, and the methods for resolving them might vary. Throughout this study and the 5 records to comply with, the primary focus gets on persons with no health and wellness insurance coverage and therefore no aid in paying for healthcare past what is available via charity and safety web organizations. Health insurance coverage is a powerful aspect impacting receipt of treatment due to the fact that both patients and doctors react to the out-of-pocket price of services. Wellness insurance coverage, nonetheless, is neither needed neither enough to access to medical services. The independent and direct impact of healthinsurance insurance policy protection access to health health and wellness is well establishedDeveloped Others will certainly acquire the health and wellness treatment they require even without health insurance, by spending for it out of pocket or seeking it from service providers who supply treatment complimentary or at very subsidized prices. For still others, medical insurance alone does not make certain invoice of care due to various other nonfinancial obstacles, such as a lack of healthcare carriers in their area, minimal access to transport, illiteracy, or linguistic and cultural distinctions. Official study about without insurance populaces in the United States dates to the late 1920s and early 1930s when the Committee on the Expense of Medical Treatment produced a series of reports about funding medical professional office check outs and hospital stays. This problem became salient as the numbers of clinically indigent climbed up throughout the Great Clinical depression. Empirical research studies regularly sustain the link in between access to care and enhanced health outcomes(Bindman et al., 1995; Starfield, 1995 ). Having a normal resource of treatment can be taken into consideration a forecaster of accessibility, instead than a direct action of it, when wellness end results are themselves utilized as gain access to signs. This expansion of the notion of accessibility dimension was made by the IOM Board on Keeping Track Of Accessibility to Personal Healthcare Services(Millman, 1993, p. Whether parents are insured appears to influence whether their kids get care in addition to just how much careeven if the kids themselves have protection(Hanson, 1998). The health and wellness of parents can influence their ability to look after their kids and the level of household anxiety. Fretting about their children's access to care is itself a source of tension for moms and dads. Three chapters comply with in this record. Chapter 2 gives a summary of just how employment-based health insurance policy, public programs and private insurance plan operate and interact to give considerable however incomplete protection of the united state populace. This includes an evaluation of historic patterns and public policies impacting both public and exclusive insurance policy, a conversation of the communications among the various sorts of insurance coverage, and an exam of why individuals move from one program to an additional or wind up

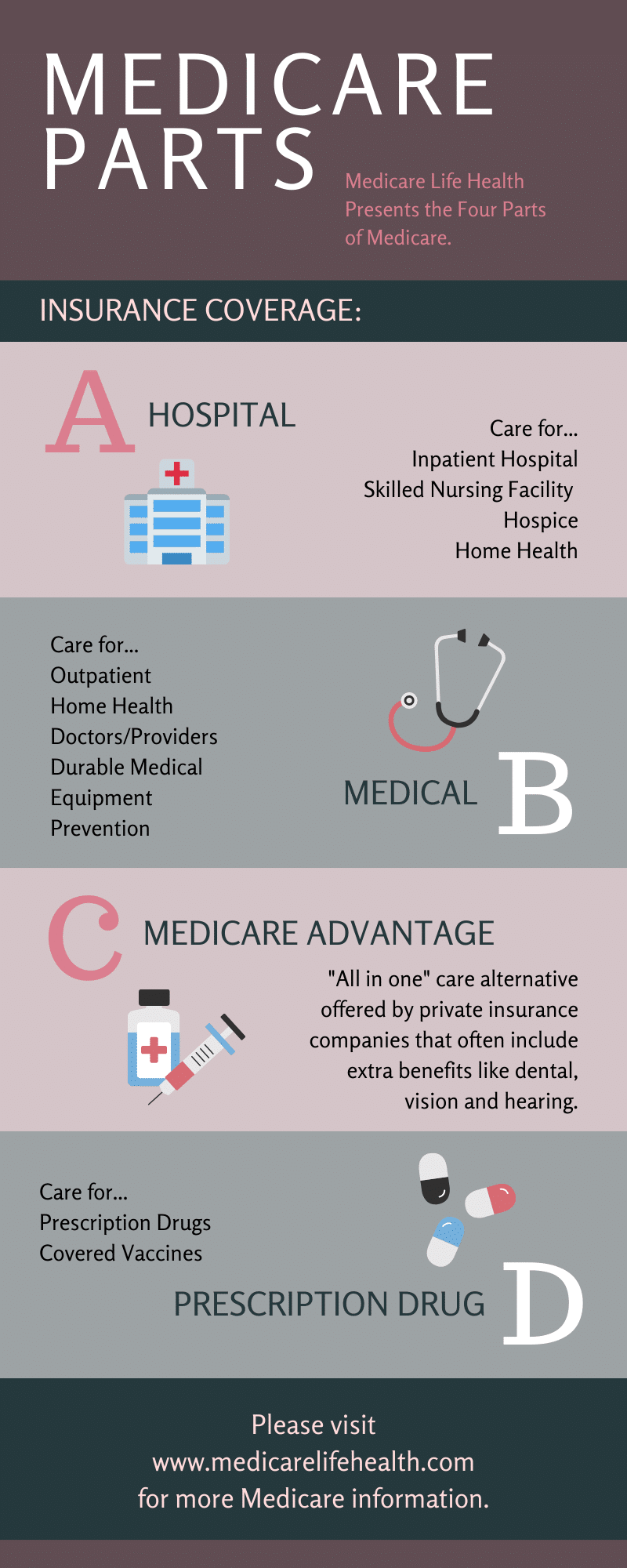

The federal government pays even more than it should for these strategies, while the involved companies make a bigger earnings. This game includes firms paying medical professionals to report more wellness issues, sharing the extra money with doctors, and even owning the medical professional's workplaces.

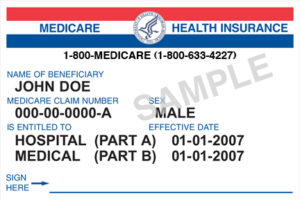

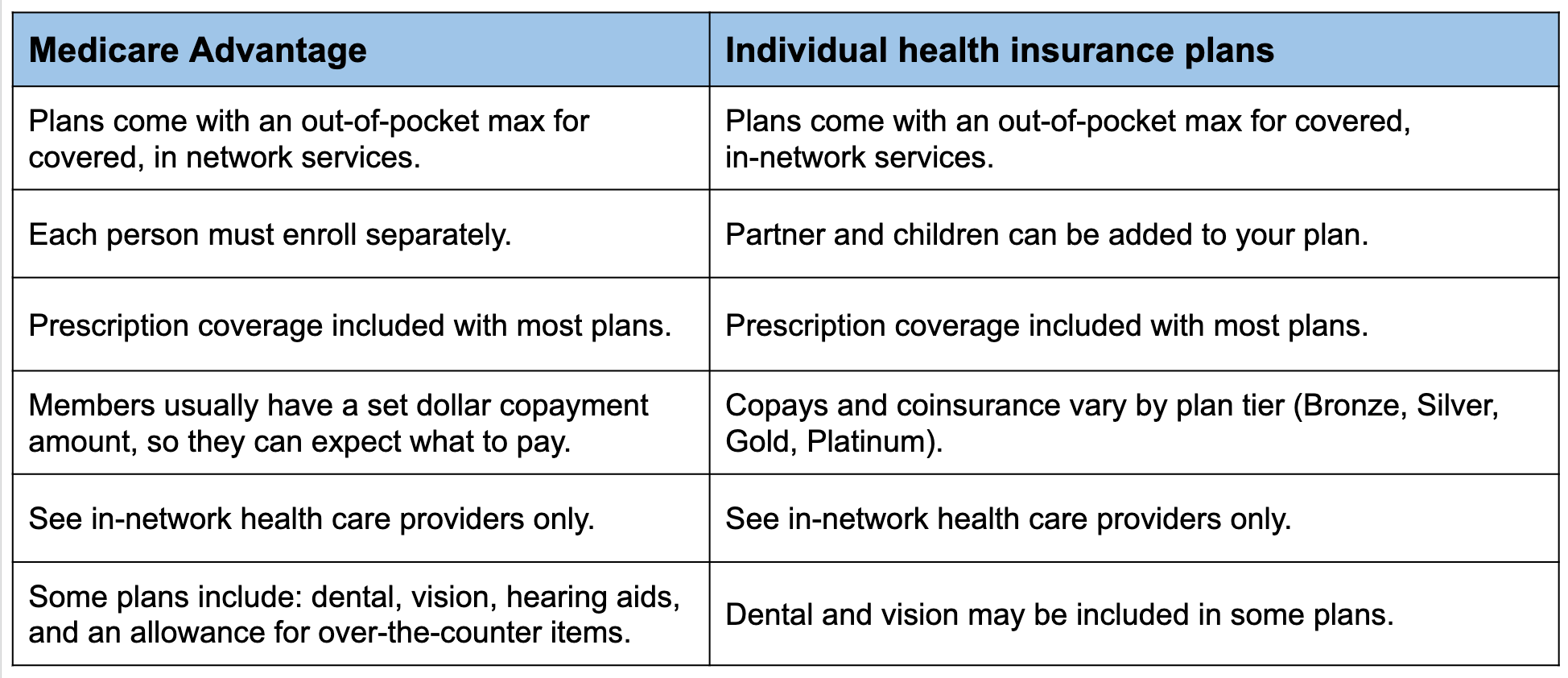

Health treatment coverage assists you get the care you require and shields you and your household financially if you obtain sick or harmed. Watch: Are you unexpectedly needing health insurance policy? All health and wellness prepares need you to

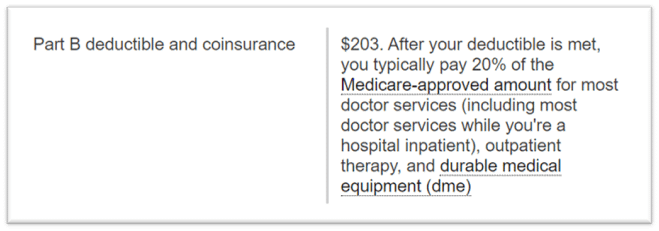

pay some of the cost of expense health careWellness

The Basic Principles Of Medicare Advantage Agent

The federal government pays even more than it needs to for these plans, while the entailed firms make a bigger earnings. This video game consists of companies paying medical professionals to report even more illness, sharing the additional money with doctors, and even having the physician's workplaces. Getting ill can be expensive. Also visit this website minor health problems and injuries can cost countless bucks to diagnose and treat.

Health and wellness treatment insurance coverage aids you obtain the treatment you require and protects you and your family monetarily if you get sick or wounded. See: Are you suddenly requiring wellness insurance? All wellness plans need you to.

pay some of the cost of price health careWellness

The federal government pays even more than it ought to for these plans, while the entailed business make a bigger revenue. This video game consists of firms paying physicians to report more health issues, sharing the added money with doctors, and also owning the doctor's offices.

Get This Report about Medicare Advantage Agent

Health treatment coverage aids you get the treatment you need and shields you and your family members financially if you obtain ill or harmed. See: Are you all of a sudden needing wellness insurance? All health and wellness intends need you to.

Our Medicare Advantage Agent Ideas

pay some of the cost of your health careWellness

:max_bytes(150000):strip_icc()/difference-between-universal-coverage-and-single-payer-system-1738546.FINAL-be2d0b3e41224890b0d379d231e79dcc.jpg)